On December 18, 2020, Law No. 27,605 was published in the Official Gazette, which establishes the Solidarity and Extraordinary Contribution to Help Mitigate the Effects of the Pandemic. This comes in addition to the already applicable Wealth Tax that has rates ranging from 1.25% to 2.25%.

The emergency contribution, which is extraordinary and mandatory in nature, is established only once and reaches the following subjects:

- Human persons and undivided estates resident in the country for all their assets inside and outside the country.

- Human persons of Argentine nationality whose domicile or residence is in non-cooperative jurisdictions or with low or no taxation.

- Human persons and undivided estates residing abroad for all of their assets in the country.

All those persons whose total value of their assets does not exceed two hundred million pesos inclusive will be exempt from the contribution.

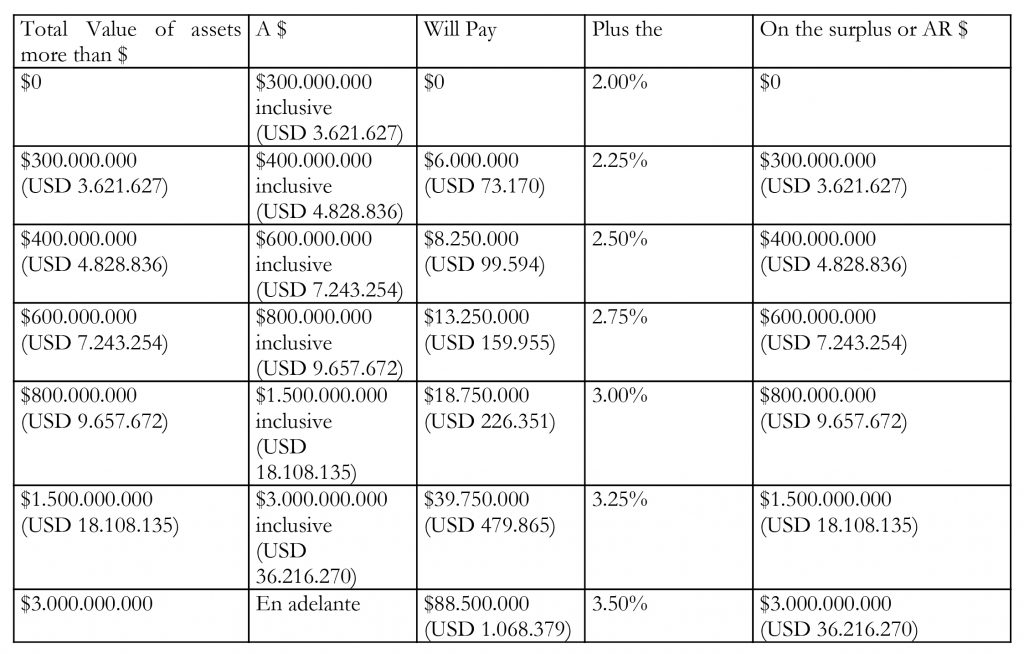

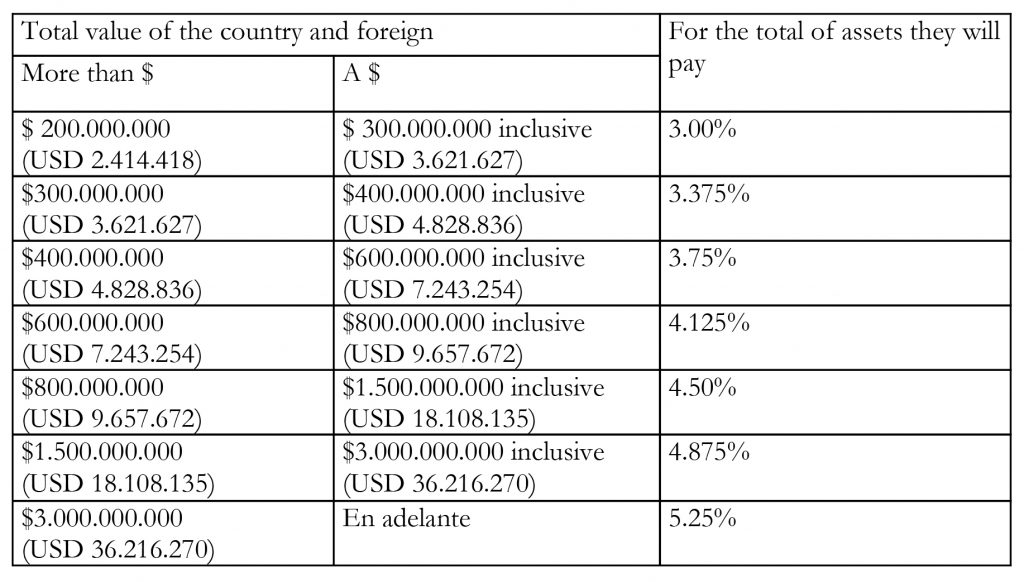

The contribution depends on the amount and location of the assets and will be calculated as follows.

For assets located outside, where the entry into the country within sixty days, inclusive, from the entry into force of the law, of the holdings of foreign currency abroad and the amounts generated as a result of the realization of financial assets abroad, which represent at least 30% of the total value d and said assets – “Repatriation” – is not verified, the contribution must be calculated according to the following table:

Deposits, credits and assets in foreign currency and their inventories located in the country as well as abroad, will be valued according to the last market value -buyer type- from the Banco de la Nación Argentina as of December 31 of each year, including the amount of interest accrued on that date.

The assets of the proceeds will be used to

- purchase and / or development medical equipment, drugs and supplies for health care.

- Subsidies to Micro, Small and Medium Enterprises

- Comprehensive Progresar scholarship program managed in the educational field

- Socio-Urban Integration Fund (FISU)

- Programs and projects approved by the Secretary of Energy of the Nation, for the exploitation, development and production of natural gas.

Happy Holidays Season.